This entry was posted on Wednesday, February 22nd, 2012 at 2:34 pm and is filed under Trading. You can follow any responses to this entry through the RSS 2.0 feed. You can leave a response, or trackback from your own site.

22.02.2012 Post in Trading

To continue the topic of previous article, we will consider some aspects of wave analysis.

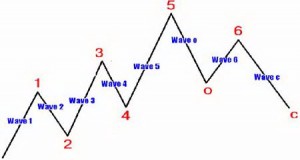

If we look at the chart of currency price changes we will see that there are several types of movement. The chart depicts the phases of descending and ascending movement as well as those of sideways movement. According to the Elliott wave theory, each market stage is a wave, which in turn is a model of crowd’s behavior. As it was mentioned before, a wave can perform the function of action or reaction. The first one moves the market within the general trend, while the second one makes it reverse.

According to the style, waves are subdivided into motive and corrective. Each market cycle is composed of motive and corrective waves. All waves of reverse movement develop in corrective style. Elliott discovered that the motive waves have 5-wave structure, while the corrective waves have 3-wave structure. Therefore, the whole cycle consists of 8 waves. Each wave can be divided into several smaller waves.

The waves can be indentified for every timeframe with the help of more than 10 wave levels. Each of them has its own name and marking. The symbols below were implemented to simplify this procedure:

Triad of symbols for higher wave levels

[1][2][3][4][5][A][B][C][D][E][W][X][Y][Z]

(1)(2)(3)(4)(5)(A)(B)(C)(D)(E)(W)(X)(Y)(Z)

1, 2, 3, 4, 5, A, B, C, D, E, W, X, Y, Z

Triad of symbols for lower wave levels

[i][ii][iii][iv][v][a][b][c][d][e][w][x][y][z]

(i)(ii)(iii)(iv)(v)(a)(b)(c)(d)(e)(w)(x)(y)(z)

i, ii, iii, iv, v, a, b, c, d, e, w, x, y, z

The following rules are used for interpretation of waves:

-

The turn of the second wave is never equal to 100% upward move of the first wave. For example, at bullish market the second wave low will never be below the beginning of the first wave.

-

The third wave in impulse sequence is never the shortest. As a rule it is the longest.

-

The fourth wave never ends in the price range of the first wave, except it forms the chart in a special way: the market movement is the same as it was before, irrespective of its size and movement period.

Analysts often use Elliott wave principles in combination with Fibonacci numbers to calculate the period and size of market movement.

-

Added by Tatyana Makhina,

InstaForex Clients’ relationship manager